And how founders can build one

Over the past quarter, nearly every founder I meet has been exploring ways to bring AI into their workflows — not as a flashy feature, but as real leverage. The CRM is usually the first place they look, and for good reason: it’s where data, follow-ups, and accountability lives.

Every software company runs on customer data, but most still manage it through a patchwork of manual workflows — logging calls, updating notes, chasing follow-ups, and pulling reports. These are necessary but repetitive tasks that drains time, teams, and lacks consistency.

A CRM agent automates those tasks. It’s not a chatbot; it’s a background system that connects to your CRM, reasons through what needs to happen, and takes action. The result is less admin, faster cycles, and cleaner data. In this post, I’ll break down what a CRM agent actually does and share a simple roadmap any founder can use to build one — no AI research team required.

A Simple Example

Imagine a rep says:

“Follow up with all leads from last week and personalize the message.”

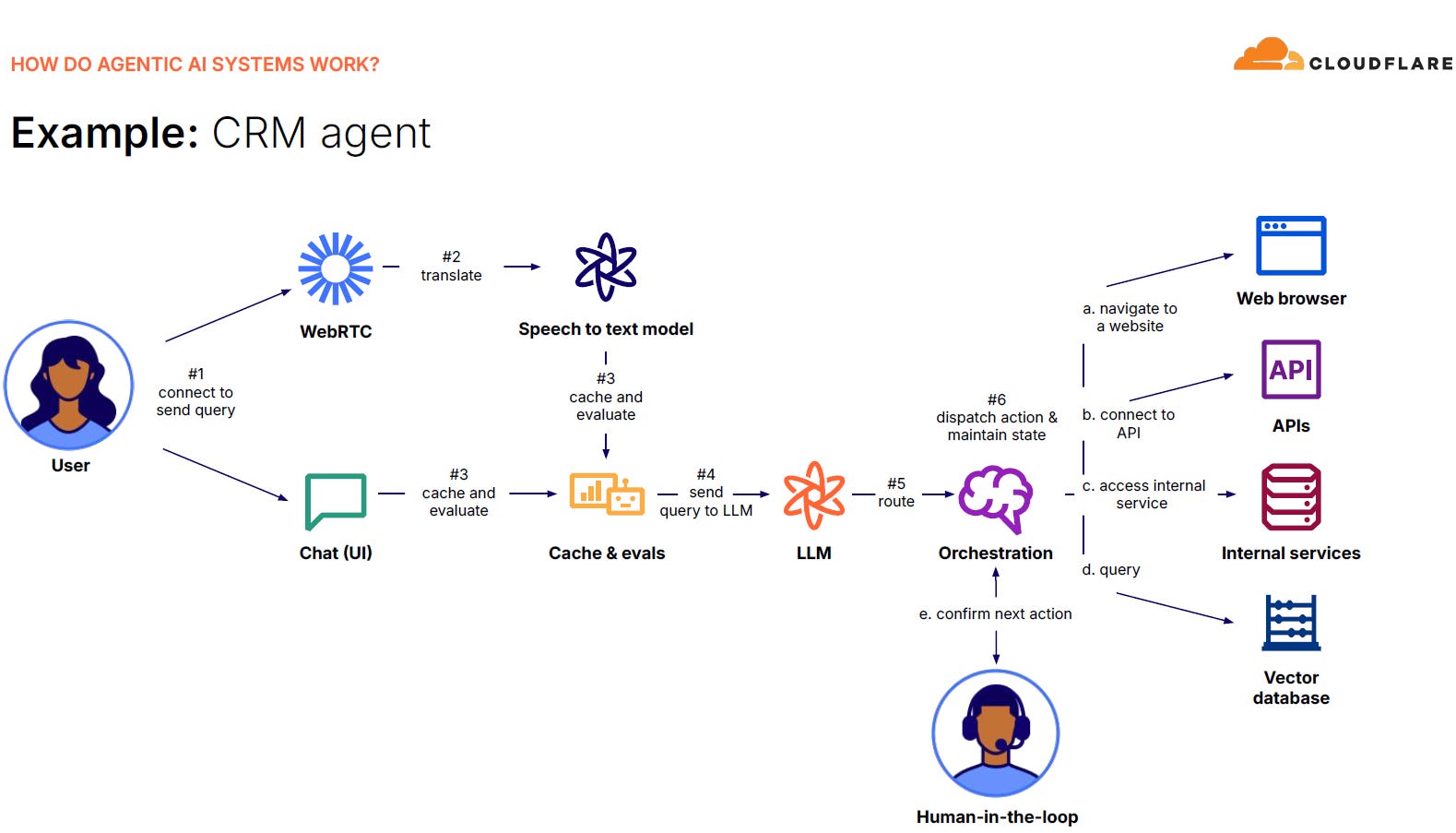

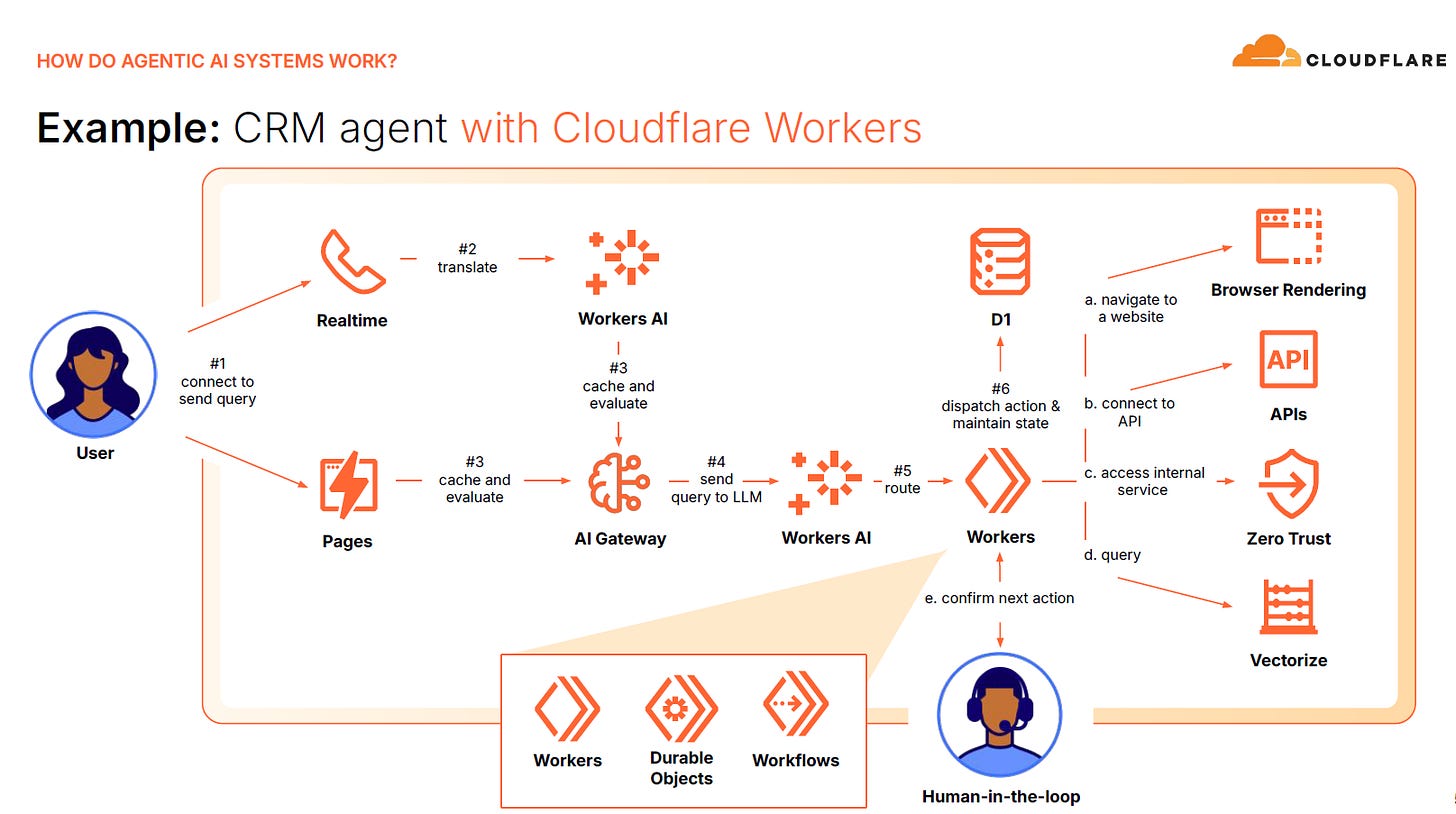

Here’s what happens behind the scenes:

- The agent queries the CRM for leads from the past week.

- It prompts an LLM to draft personalized emails based on each profile.

- It sends those messages through the CRM’s native system.

- It logs each interaction automatically.

The LLM handles reasoning and content.

The workflow layer ensures ordering and reliability.

APIs provide access to the CRM and communication tools.

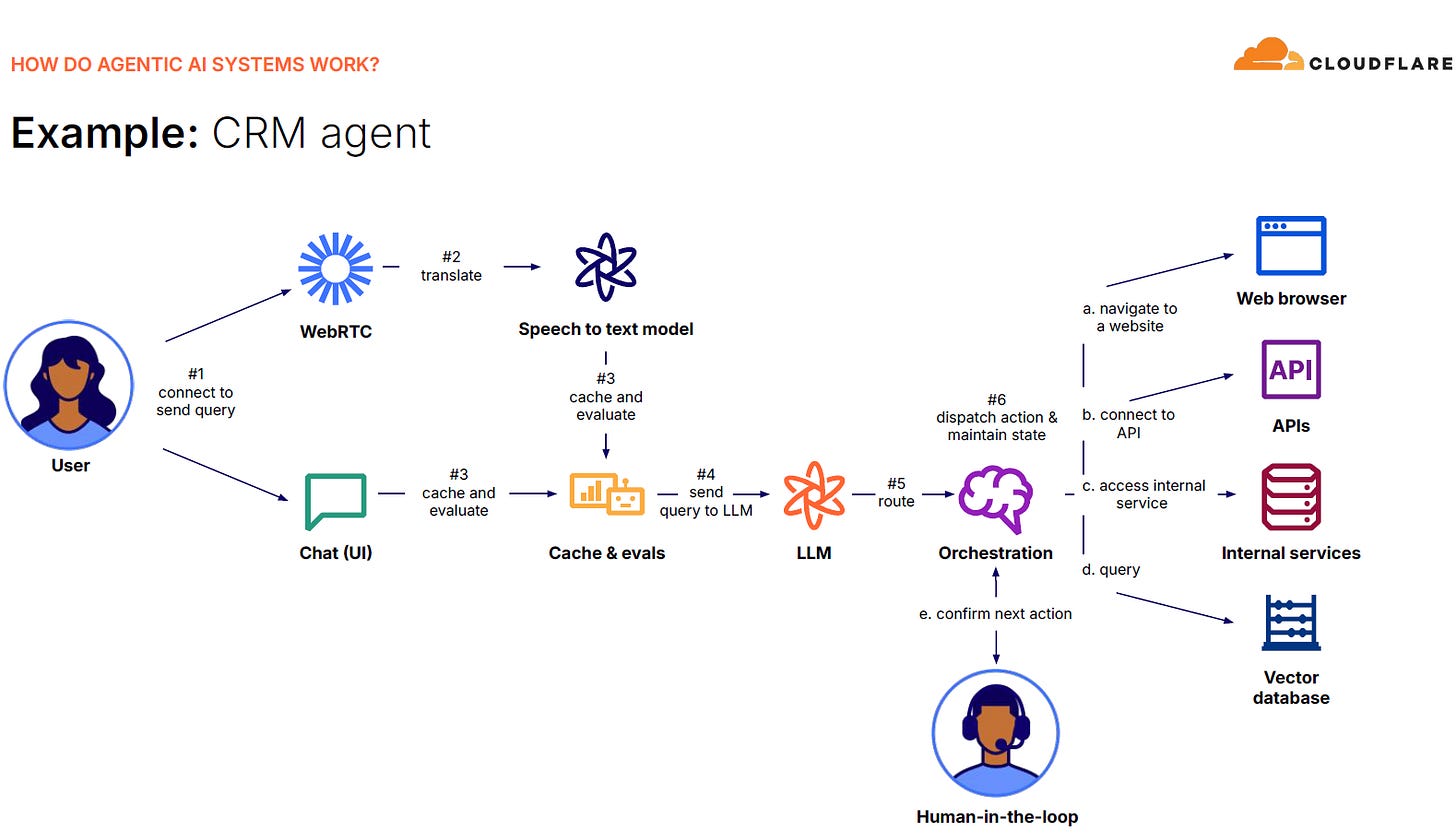

Cloudflare outlined this exact stack in its AI presentation earlier this year (see below). It’s the clearest blueprint yet for how agentic systems will interact with enterprise software.

We’ve seen early versions of this inside portfolio companies — one founder built a lightweight agent that automatically logs post-demo notes into HubSpot. It saved reps 5+ hours a week and surfaced missed follow-ups they didn’t even realize were slipping through.

Where the Data Comes From

Frontier models like GPT-4 or Claude 3.5 are generalists. They’re trained on massive public datasets — think the entire indexed internet.

But to make a model useful inside your company, it needs domain-specific knowledge in two areas:

- Workflow data — how your team actually sells, follows up, and reports.

- Customer data — the proprietary context inside your CRM, emails, and notes.

Training a model from scratch is prohibitively expensive, so the practical path is to adapt existing models using three common techniques.

1. Retrieval-Augmented Generation (RAG)

RAG gives your model access to private data — docs, FAQs, CRM records — via a retrieval layer. When a query comes in, the system fetches relevant snippets and injects them into the prompt. Think of it as giving your LLM an open-book test.

2. Fine-Tuning

Fine-tuning uses labeled examples from your domain (e.g., great email threads or sales summaries) to train the model to mirror your tone and reasoning style.

3. Tool Use & Function Calling

The most powerful agents act, not just answer.

Tool use lets an LLM call external systems — CRMs, ERPs, HR databases — to execute real-world actions. That’s how a CRM agent can actually send emails, update records, and sync tasks rather than just suggest them.

How Founders Can Get Started

If you’re a founder, you don’t need a research lab to build this. Start simple:

Step 1: Pick a narrow, high-leverage use case (e.g., “automate weekly lead follow-ups”).

Step 2: Use an off-the-shelf LLM and connect it to your CRM via APIs.

Step 3: Add RAG to ground the model in your company’s data.

Step 4: Layer in human-in-the-loop review so you can trust and improve the system.

Tools like Zapier, LangChain, or Dust make it easy to prototype this without a full engineering team. Start with a single API connection and measure the time saved — that data will justify expanding into more workflows. Once you prove value in one workflow, expand from there. Each agent you build compounds efficiency across the org.

The Bottom Line

CRM agents aren’t futuristic — they’re the next logical evolution of software automation. Founders who start building these systems today won’t just save time — they’ll redefine how their teams operate.

Every company that depends on customer relationships will eventually use one.

The earlier you start experimenting, the faster you’ll compound the benefits: cleaner data, faster execution, and a sales team focused on strategy, not spreadsheets.

Building one isn’t just about AI — it’s about leverage. And if companies like Cloudflare are already running more efficiently because of it, the question is how long others can afford to wait.

A New Era of Tech-Driven Care in Dentistry

One of my first “jobs” was working in my Mom’s dental office some 20+ years ago. The core responsibility I was initially tasked with was writing her ‘recall’ cards – postcards that communicate oral care reminders to patients.

I would write them by hand, and we would batch-mail my output at the end of each workday at the mail annex she co-located with (as an aside, a Mom business lesson, locating adjacent to a post office is an OG growth hack for constant foot traffic and net-new patient growth, but Lessons from Mom should make for a dedicated post for another day)…My starting salary was 10 cents a card! Talk about aligned compensation 🙂

I learned many things from that time in my life, but what remained particularly ingrained in me was just how hard solo practitioners must grind to scale and how painfully manual most providers’ workflows are.

We’re looking to back businesses that change that! The following post was shared on Ansa’s blog on 12/25/2023, touching on some of the angles we’re exploring.

***

As we enter the holiday season, we wanted to highlight an area we have been focused on at Ansa for the past few months: dentistry. Dentistry holds a special place for us at Ansa. Not only is it a field ripe for technological innovation, but it also resonates with us on a personal level. Marco’s mother is a dentist, and Duncan’s grandfather was a dentist. We know visiting the dentist isn’t everyone’s idea of a good time, but that speaks to the opportunity. We believe technology is the key to transforming dental visits from a dreaded chore into a surprisingly pleasant experience.

Ansa’s View of the Dental Tech

Where Dentistry Sits Today

Dentistry represents a significant chunk of healthcare spending in the United States. Taking care of our teeth is one of a limited number of activities we do twice daily (and anyone who follows the recommended 2 minutes twice a day from the CDC will spend nearly 1,000 hours over their life span brushing their teeth), which drives home the importance of dental care in our daily lives.

There are over 185,000 practices and over 200,000 dentists in the United States to service this need. Over 25,000 students graduate from dental school annually. All focused on the importance of teeth and oral health. Dentistry is a huge, growing industry. This is particularly poignant considering the global scale of dental health issues, with an estimated 3.5 billion people facing oral health problems. Unsurprisingly, it is an industry that already supports massive, complex organizations selling into dentist’s offices like Henry Schein (NASDAQ: HSIC) and Patterson. As we explore investing in the space, we have seen a handful of ways to dramatically improve the revenue and profitability of these practices.

Trends Reshaping the Dental Industry

The Emergence of DSOs:

The rise of Dental Service Organizations (DSOs) marks a significant shift in the industry. High dental education costs have made it challenging for new graduates to start independent practices. Over the past 40 years, dentist’s incomes have tripled, but dental education costs have skyrocketed, rising 16 times. This steep increase in tuition makes it increasingly challenging for new graduates to start independent practices, as student loan repayments consume a larger portion of their income.

Many new dentists find joining existing practices, often DSOs, a more viable option. DSOs offer operational efficiencies and access to technological advancements, as highlighted in a 2023 report by the American Dental Association. The industry is witnessing a trend of acquisitions by large, equity-backed DSOs ranging from large consolidators like Heartland and Pacific Dental Services to more localized groups like Singing River Dental Partners. However, despite this consolidation, a significant majority of practices — 93%, according to Harris Williams — remain independent. This balance between DSO-driven consolidation and the persistence of independent practices marks a complex and evolving landscape in dentistry.

While some might decry the loss of many independent dental practices, consolidation by DSOs allows for more advanced procurement and a deeper focus on efficiency. While individual dentists primarily focus on providing dental care, larger Dental Service Organizations (DSOs) have the advantage of employing specialized roles such as heads of strategy, Chief Technology Officers (CTOs), and other administrative functions. These professionals dedicate their time and expertise to actively identifying and evaluating opportunities to enhance their practices’ overall performance and efficiency. For young, high-growth technology companies, partnering with Dental Service Organizations (DSOs) presents an excellent opportunity to scale rapidly, bypassing the usual challenges of competing for a dentist’s limited time and attention.

Increased Consumer Demand:

According to the 2023 State of America’s Oral Health and Wellness Report, 92% of Americans recognize oral health as crucial to overall well-being. This shift, especially among younger populations, is propelling a demand surge for quality dental services. This growing consumer focus is reshaping the industry, leading to an increase in preventative care services and a higher standard of patient experience.

Additionally, the aging US population is bringing dental health into sharper focus, similar to other healthcare segments. Age-related oral health issues are escalating the need for specialized dental services. A GSK study illustrates some of the generational differences in oral health – younger consumers tend to be more diligent in their dental hygiene practices and have a better understanding of the link between oral health and other health complications. Over time, an increase in the desire for high-quality oral health is a benefit to dentists and the technology companies serving them. The landscape is shifting towards a future where superior dental care is not just a need but a priority for a growing and diversifying client base.

Staffing Challenges Prompting Efficiency:

One of the most pressing challenges faced by dental practices is administrative staffing. A third of dentists report needing more dental hygienists or assistants, and a quarter of dentists need help finding a sufficient number of office or administrative staff. Adding to this issue, dental assistants and hygienists frequently cite being overworked as a primary cause of job dissatisfaction.

This challenge is intricately linked to the need for more efficient operational practices. By integrating AI and automation technologies, dental offices can alleviate the administrative load on their staff and improve overall operational efficiency.

Investment Focus Areas at Ansa

We’re directing our investments toward areas where we believe technology can make a transformative impact:

- AI and Dental Imaging: AI is revolutionizing dental diagnostics. Beyond aiding dentists, AI technologies that have been trained on multitudes of dental images can help patients and insurers understand dental conditions more clearly. They not only support diagnoses and improve dental workflows but also open up new revenue streams by identifying additional treatment opportunities and allowing for better patient communication. The value of AI in dental imaging lies not in replacing dentists’ expertise. Instead, its strength resides in ensuring consistency across diagnoses, improving operational workflows, and elevating the quality of customer communication. Companies like Pearl, Videa, and Overjet are working to improve practice and dentist efficiency.

- Innovations in Business Operations:

Transforming Procurement: The current procurement landscape in dentistry is largely controlled by a few high-margin resellers, offering limited differentiation in their products. The time is right for innovators like Torch to challenge incumbents with stronger, more intuitive, and more automated procurement technology.

Customer Engagement for the Digital Age: Digital marketing and customer communication tools tailored for dental practices are changing how clinics contact and interact with their patients. These solutions are about attracting new patients and building lasting relationships, ensuring patient satisfaction, and ensuring lasting care. Platforms like Peerlogic are a game-changer for busy dental offices, where administrative staff are often overwhelmed, ensuring consistent and effective patient interaction without adding to the staff’s workload.

Modernization of Revenue Cycle Management (RCM) and Billing: The administrative side of dental practices, especially billing and reimbursements, is ripe for automation – particularly given advances in OCR and document ingestion. Traditional reimbursement workflows are typically labor-intensive and inefficient. Even modest improvements in these processes can yield significant time and cost savings. Automating these aspects of practice management with platforms like Retrace or Zentist not only streamlines operations but also allows dental staff to focus more on patient care and less on paperwork.

A Call to Action for Dental Tech Innovators

If you’re a founder or innovator in the dental technology space, we want to hear from you. And if you’re building in the space and raising a Series A-C, reach out to duncan@ansa.co or marco@ansa.co.

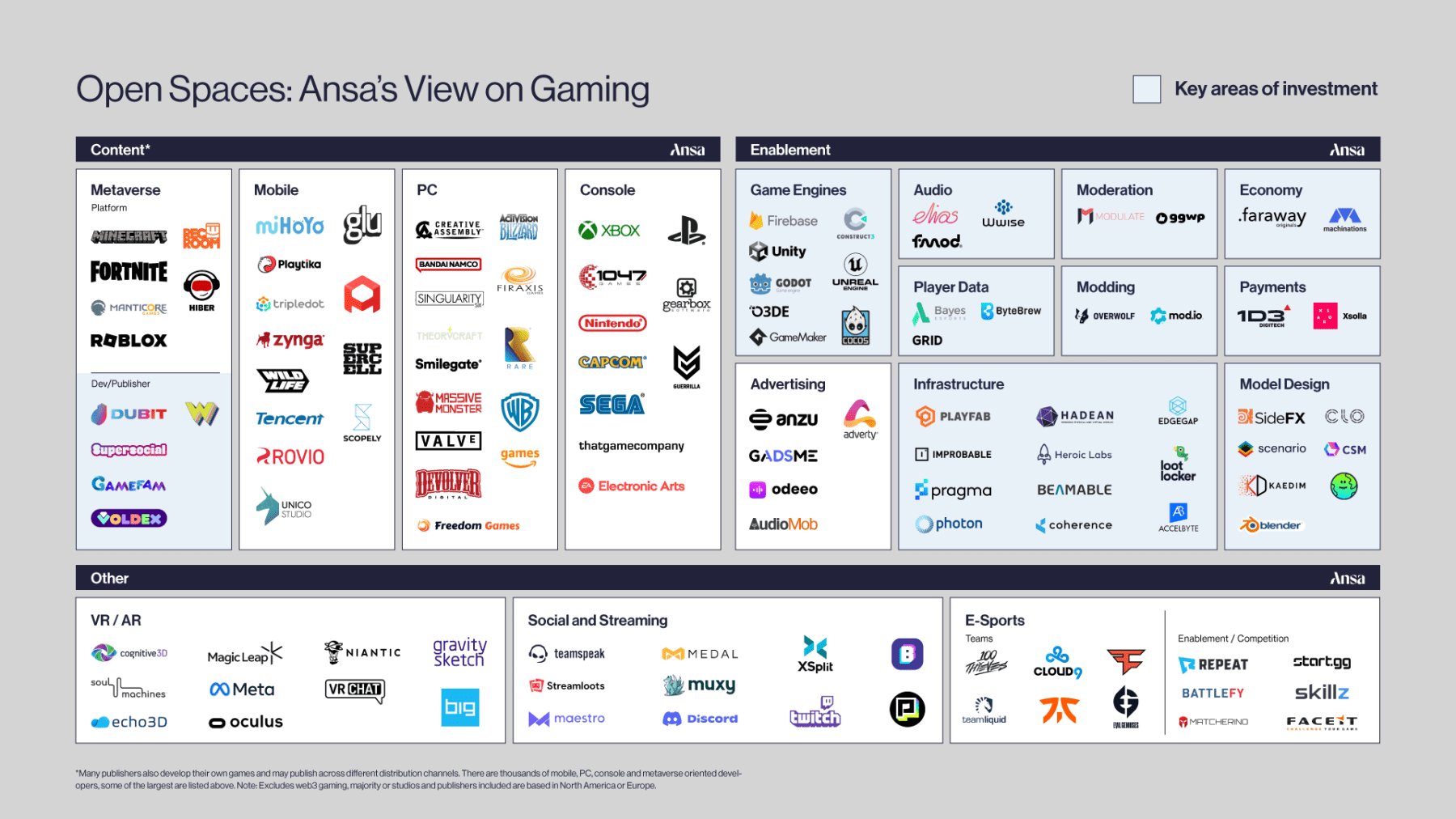

So, the last time we wrote about gaming, Duncan was deep in Baldur’s Gate. Weeks later, after we pulled him out and got him some sleep, it felt like time to share our market map on the space. Building upon our team’s recent Open Spaces [our signature series of white paper-style articles exploring our thesis areas], we’re introducing our Gaming Market Map – which highlights our partnership’s views on the gaming industry’s rapidly changing face, spanning content, enablement, social, streaming, and much more.

The top 3 questions we get from gaming CEOs we meet when considering an investment are:

- What is our in-house POV on the gaming universe?

- Where are we actively investing in the category?

- Why should an entrepreneur in this space work with Ansa?

This post touches on each, and we hope it shows we’re not just observing the ecosystem – we’re behind the scenes in partnership with founders helping to define it.

Introducing our Gaming Market Map:

As we’ve started to invest in the gaming renaissance, we distilled this landscape into a couple of pivotal areas we’re focused on.

Content

Content is the lifeblood of gaming, which is why we invest in this space. When we back a business in this space, we go beyond supporting their in-house development infrastructure. We also help them draw game content from three other channels – Hollywood IP licensing, third-party publishing, and M&A. Similarly, we know ourselves well enough to know who we’re not for – we don’t back AAA studios pre-launch, for example, and have no interest in competing with Xbox for a title launch on their console. Instead, when we work with publishers, we prefer to build platforms that enable an edge outside of capital or content, ideally, in a net-new ecosystem. In certain cases, we aggressively pursue partnerships, license quality IP, and supplement 1st-party game development with 3rd party publishing.

For a management team, these capabilities are an unlock we’re quite proud of.

As a partnership, we aren’t prescriptive on the “what.” From action-packed RPGs to immersive virtual worlds, we believe there is something for everyone and aren’t in the business of simply checking boxes. That said, we’re excited to see studios and developers are not only pushing the boundaries of storytelling, graphics, and gameplay but also championing inclusivity and representation. We’ll always have a soft spot for content as gamers ourselves.

Enablement

The largest area of investment focus for us has been the enablement layer, which we define as software tools targeted at key areas of game development. As consumers and publishers demand more complex games on tighter timelines, developers require software tools to drive speed in the development process independent of adding incremental headcount. Historically, developers would try to accomplish this by stitching together homegrown or open-source tools built for short-term wins (e.g., a single game) instead of long-term usage. The entrepreneurs who resonate the most with us have recognized that this is a clear opportunity to drive value for studios, publishers, and the gaming community via commercial software tools.

It only takes looking at a game like Among Us to understand the power that efficient game creation can have. A studio of four people created the game. In under a year, they developed and launched multiplayer mode and grew to over 3.8 million concurrent users at peak. Our mission is to back tools that can enable rapid development and growth, and we are actively investing in this space.

Within this ‘modularization’ of game development, we are actively pursuing new investments in the following areas:

- Moderation: A few minutes on a losing team in any League of Legends or Overwatch ranked lobby can rattle even seasoned gamers. Tools that can help moderate not only competitive games but the large group of games targeting younger segments of the population will only get more critical as people spend more time online. One only has to look to last week, when Roblox acquired Speechly, to see how high a priority moderation is to teams.

- Economy Management & Player Data: As games continue to transition to recurring revenue business models (almost every top-grossing mobile game is freemium), there has been an increased focus on the value of player retention and monetization.

- Modding: It doesn’t take long to find a hugely popular game originating from a mod (League of Legends, CS: GO, PUBG). We see modding as not only a key avenue to new game loop creation and a path to game longevity but as an interest of a growing young group of players who have started their gaming careers on platforms like Roblox.

- Infrastructure: Multiplayer games are inherently difficult and expensive to build, and the backend networking and infrastructure to support player interaction quickly can become complex. Infrastructure tools are a necessity to produce multiplayer games efficiently both in development and as they scale.

- Model Design: Game asset creation can take up significant chunks of game development budgets. We see early traction in reducing model design and creation workflows through technological advancements like generative AI and other workflow-oriented tools that can reduce manual processes in asset creation.

As a firm, we’re hyper-focused on investing in these areas. We believe in the silent forces powering unforgettable gaming moments: the software products and technological foundations necessary to serve both gamers and developers at scale.

These products are not just the gears in the gaming machinery; they are key businesses in democratizing game creation, ensuring that aspiring developers and studios have access to the resources they need. Ansa has built strategic relationships with studio execs to help drive revenue to businesses we back in the space, as the majority of them focus on publishers and platforms we’re close to (after all, why else hire someone who worked at PlayStation ;)).

If you’re building in the space, are post-monetization, and are exploring raising a Series A through C in the months to come, don’t hesitate to reach out to Marco DeMeireles, marco@ansa.co, and Duncan McGillivary, duncan@ansa.co. We’d love to explore partnering with you.

By Marco DeMeireles and Duncan McGillivary

The gaming industry is undergoing a radical transformation. With over 3 billion players as of 2023, the future of gaming has arrived, and it’s shaping up to be more awe-inspiring and boundary-breaking than ever before.

Fueling this rapid growth is the development of new game engines and development tools that make it easier for anyone to create a game, the rise of crowdfunding platforms that allow developers to raise money for their projects, and the growth of digital distribution platforms that amplify game accessibility.

At Ansa, we believe that the companies that evolve from upstarts to household names are the ones that take advantage of “open spaces” — opportunities that emerge as consumer behaviors shift, distribution channels evolve, and markets take shape. The gaming industry is a prime example of this changing landscape and one of the key focus areas for our team.

Below, we’re outlining some trends leading to some of the most exciting — and investable — openings, from demographic shifts to new tech tools.

Everyone is now a Gamer

Within this transformation, a new population of gamers has bloomed. Constituting a formidable 48% of the player base, women have emerged as a potent force within the gaming domain, and the archetypal gamer is also older than you might think. People over 65 devote more time to gaming than those between 35 and 64. This expansion in the player base presents an opportunity, as the landscape is ripe for studios and platforms to reach a broader range of players.

Yet, while the landscape flourishes with diversity, women remain underserved. Despite their significant presence, they are often alienated by the content and marketing of games, which are typically male-oriented. 71% of mothers now play video games, signaling an untapped demand for puzzle-style games, such as the universally adored Candy Crush.

While there have been strides in recent years, with characters like Angrboda from God of War: Ragnarok and Sojourn from Overwatch, too few games feature diverse characters and stories. This lack of inclusion can be alienating for players of color. The future beckons to champions of creative narratives, ready to carve the path toward more comprehensive and inclusive digital realities. Our focus on new markets at Ansa draws us to opportunities that support underserved communities, and we get excited about platforms that can draw in new players.

Farewell to the Traditional Storefront

The traditional channels of distributing games through physical stores and digital marketplaces are quickly becoming outdated as new distribution channels emerge. One of the most promising new distribution channels is games within games. Rather than going directly to Steam or the Microsoft store to find that content, hundreds of millions of players find games they want within the ecosystems where they are already playing. Players can encounter captivating content within the realms they already inhabit. This model can potentially reach a larger audience of players while leveraging IP in a similar way to the early days of mobile.

At Ansa, our ethos is entwined with cultivating pioneering startups within nascent ecosystems. We seek out first movers who can profitably bring high-quality IP and content and rapidly scale using their best practices. We’re also thinking about the future of premium IP. Where will WWE be taken next? How can we bring the world of Harry Potter to life in a new and innovative way? These questions fuel us as we dive into gaming’s tomorrow.

Next-Gen Developer Tools are Here

As games have become more complex, studios have sought solutions to eliminate manual, time-consuming, and expensive game development processes (such as building standalone backends, moderation tools, and economy management platforms). This has led to a broader ecosystem of gaming-oriented development tools, including asset creation and management platforms, back-end management, moderation, and game economy management.

Just as many companies license their game engines today, many studios of tomorrow will choose pre-built solutions for their development stacks. The next generation of tools is still being developed as founders embrace and implement technologies like generative AI to enhance gameplay experiences. The deployment of generative AI and innovative technologies signals a new frontier of seamless gameplay experiences, a terrain we at Ansa invest in ardently.

The Democratization of Game Creation

New technologies allow for a low barrier to entry, as anyone can create and publish games, regardless of their budget or experience. Platforms like Unity and games like Among Us have scaled swiftly despite smaller teams. The viral social deduction game was developed by Innersloth, at the time a team of three, before eventually scaling to hundreds of millions of downloads and over $86M in lifetime revenue by June 2021 (source). GameMaker and Roblox’s native game design tools allow for even more accessible game creation, empowering less technical users.

We expect that game creation will continue to see democratization over time, leading to new gameplay loops, viral games, and ways to play without requiring the capital intensity of large AAA games. We get excited by studios and publishers that can leverage the next generation of these tools, combined with innovative game loops and world-class teams.

Looking Ahead

Spending time with operators and founders in this space has shown us the industry is in flux, with uncharted territories and untapped potential. The themes discussed in this blog post are just a few ways gaming is changing. As the industry continues to grow, innovation and creativity will converge, beckoning pioneers to sculpt the future of gaming.

To the creators and visionaries building the next generation of games and gaming tools, please get in touch. We love having these conversations. Ansa primarily invests $5-30M into post-monetization startups at the forefront of gaming’s bright and promising future. Are you already on the path to constructing this very future? If so, we eagerly encourage you to connect with Marco DeMeireles, marco@ansa.co, and Duncan McGillivary, duncan@ansa.co.

Where Subscriber Lifetimes Outlive Funds

Hidden Opportunities in “Software-Driven Systems”

As an investor, I don’t know if I love anything more than backing a new set of physical products or experiences that integrate a subscription model to deliver value for consumers.

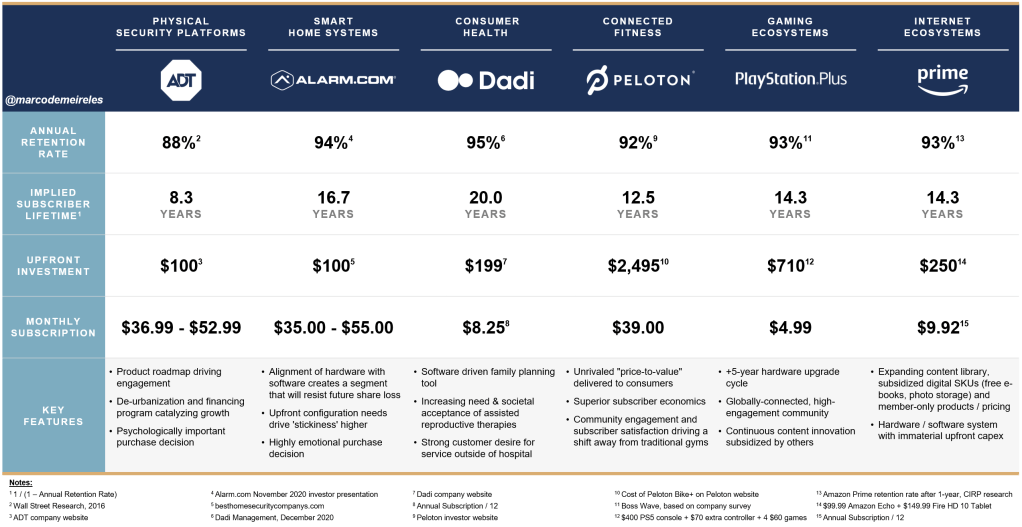

I gravitate towards businesses that broadly fall into two buckets: (1) the creation of a new market (eg. PlayStation Plus) or (2) the application of a new business model to improve an old market or service (e.g. Alarm.com, or Dadi):

While I am lucky to be a Board Member or institutional investor in many of these, I got involved because I deeply believe these businesses have some of the most compelling unit economics I’ve seen in my career. AND YET, they were underappreciated and ignored by investors for the majority of their early-stage lives, and, in some cases, through their IPOs!

But it is not often you see implied subscriber lifetimes outlast a fund’s life. When I do, I lean into it.

As a point of comparison, consider the overwhelming majority of mobile consumer subscription apps alongside the group above. Many a la carte applications have raised hundreds of millions in preference (individually!), but often these businesses have significantly worse fundamentals (e.g. churn, pricing power) and do not achieve enduring success.

The thread that ties the companies above together is that their subscriber base is centered around hardware or a physical experience. Importantly though, these are not businesses which simply slap a subscription on top of an existing offering (which we see a lot of in this market), but intentionally designed products that integrate software to create value across high frequency interactions or emotionally sensitive purchasing decisions.

And while investors have had an aversion to hardware-centric subscription models, it’s clear that not only can the retention dynamics be better than many segments of pure-play consumer apps, but so can the moats, purchase psychology, and long term FCF yield.

Many VCs don’t believe it and some are even skeptical after I walk them through the numbers like the above. I welcome that.

As Fred Wilson likes to say, this is how new funds outperform — avoid “me too” investing.

Lastly, I share this as an example of why I believe it is critically important for emerging investors to develop a nuanced thesis – ideally one refined through experience, and overlooked by the market. This is the only way I’ve found it’s possible to (a) gain the domain expertise needed for a sustainable investment advantage, (b) cultivate the open-mindedness required to see opportunity others won’t and (c) have conviction where others don’t.

When I look to the coming year, I am particularly interested in finding software driven systems within health & wellness, gaming and sustainability. I strongly believe the best businesses in these spaces will not be standalone mobile applications, but rather full-stack systems often with a physical or experiential component. I welcome the skeptics, just as we did in financing Dadi, Peloton and Latch, from Series A through IPO.

Founders who are building in this full-stack approach benefit from working with an investor who has walked the factory floors in Taiwan, knows complementary go-to-market channels, and has the product sensibilities in both hardware and software to drive increasing value for the customer each month.

Ultimately, customers are the voting machine, and they speak with retention. And as the data above suggests, an elegant “software-driven system” may be the best approach.

If that resonates with you, get in touch on Twitter.

Special thanks to @Joanne Schneider DeMeireles @Brett Bivens @Ian D’Silva @Nikhil Basu Trivedi and @Eric Crowley for helping crystalize my thoughts, the entrepreneurs I’m so fortunate to work with, and my partners over the years who enabled me to find my game and take smart risks in the businesses above. Originally published at https://marcodemeireles.substack.com.

Investing in “Confusion”

A key principle I’ve picked up from Jim Breyer over the years is to “invest in confusion.”

Massive confusion in growing markets represents an enormous arbitrage opportunity.

Confusion in this context can refer to a newly available technology, or to changes in the economics of supply, production and/or distribution of a good or service. It can also be driven by regulatory changes, changes in a competitive landscape and so much more.

While confusion manifests itself in different ways, it’s clear that not only are these the moments in time that are uniquely positive for emerging businesses, they are the cornerstone of my most successful investments.

This holds true across sectors. Consider:

- Databricks successfully commercializing Apache Spark in the face of legacy vendors with larger sales forces and larger spark investments (IBM)

- The ballooning impact of Facebook, Pinterest, Twitter, Reddit, et. al on our communities in contrast to Yahoo’s inability to move into social networks

- Netflix and Hulu’s clear victory delivering a streaming offering that captures, serves and delights subscribers before legacy media got there

I could share a list of 100 more examples, but you get the point. Massive confusion of legacy players often renders them unable to compete, and paves the way for a new set of enduring companies.

Often, the only option for these established businesses is to buy into the market, but they rarely pioneer a market when confusion runs high. This is partly why the NYSE did not build Coinbase, and Splunk did not build Confluent.

For investors, confusion presents an added benefit of making it less likely that the market is appropriately pricing related investments. Often, it is because these companies don’t fold into a simple existing total addressable market definition, and/or have elements (including business models) that not many have underwritten in the past.

The best way I’ve been able to navigate this is to (1) dig deep into the platform shift by speaking with every participant (customers, competitors, industry analysts, founders and operators) (2) actually listen intently – with “Dumbo Ears!” and (3) force yourself to tune out the crowd. I can’t tell you how many times I heard “No one makes money in media,” “Crypto is a fad,” or “Hardware is hard; it doesn’t scale” before backing teams proving folks wrong.

Do you believe there are certain shifts happening that established market leaders are confused about? Get in touch. I’d love to talk with you about it.

Why Now

A key question you hear in many investing conversations — but not enough!—is “why now?” Over the last 10 years, I’ve focused on becoming more disciplined in answering this question every time I map out a new market or explore a new business.

“Why now” could be that a newly-available technology enables a new service, such as the introduction of Broadband and subsequent roll-out of 5G, which catalyzed the widespread adoption of streaming-services like Netflix into homes and devices around the world. Or that patent expiry, like Invisalign’s, which cleared the way for Smile Direct Club, Candid, and Uniform Teeth to improve upon a dated approach with superior service and pricing. Or large behavioral shifts like the destigmatization of mental health, and related self-care movement, which paved the way for digital tools like Headspace to be a service consumers are proud to download and employers tout as a benefit rather than a fringe or shameful need.

Often, the simplest “Why Now” examples to understand are regulatory, which is what I’m going to focus on in this post. I’ll cover other angles in future posts.

To understand the power of getting the timing right, consider the following two examples:

US Consumer Finance: The Rise of Mobile Neobanks

- The Credit Card Act of 2009: Banned marketing of credit cards on college campuses, increasing the average age of credit card acquisition and leaving more young people in the last decade to depend on other means (ie. debit).Debit card users don’t want to overdraft, let alone incur related fees while working with a UX that left much to be desired. This interplay spurred a number of downstream consequences, including the increased adoption and engagement of personal financial management tools which can track spending in real time (among other functions).

- The Durbin Amendment of 2010: Reduced debit interchange rates for banks >$10B of assets from 155 bps + $0.04 to 5 bps + $0.21. This minimized the historically sizable profit pools that made servicing “low-value” checking accounts interesting to these types of banks. Thus, a legislative change disincentivized large incumbents from serving this population segment as they were precluded from charging sizeable fees to a large swath of accounts.What was the net result? Multiple segments of the market (young people, “underbanked” populations) began looking for better alternatives and upstarts like the Cash App, Chime, Varo Money, Moneylion, were able to cost-effectively take and better serve these customers.The timing of these two regulatory catalysts, coupled with a number of other factors, drove a strong “why now” for a large segment of fintech businesses. These businesses have seen strong product-market fit and billions of enterprise valuation creation.

US Telemedicine

Historically, the establishment of a “valid doctor-patient relationship” precluded the growth and penetration of telemedicine across the states.

Just 10 years ago, remote methods for establishing a valid relationship remained in legal limbo. Texas was the last US state to allow for remote validation following a landmark ruling involving Teladoc, and more recent regulation (ie Ryan Haight Act) has catalyzed the ability to facilitate online treatments and services across new use cases.

Now of course with the current pandemic climate, we are seeing even more widespread relaxing of these regulations which we can expect to pave the way for even greater use cases.

And this is what makes our job as investors and founders so interesting. It’s a constant exercise in understanding how changes to our world will enable greater innovation and usher in significant value creation. And how we capture that.

“Why now” unlocks this conversation.

Are you in the early stages of building something and have a compelling “why now?” If so, get in touch with me on Twitter. I’d love to talk with you about it.

Our Investment in Latch

We’re thrilled to welcome Latch to the ‘BAMily’ as an investor in their $70M Series B — alongside our friends at Brookfield, Lux, RRE , Primary Venture Partners and some of the biggest names in real estate.

At BAM, we’re big believers of companies integrating data, hardware and software, to deliver a superior product and provide value in ways previously untapped. As multi-family property owners look to lower the cost of package delivery, for example, and delivery carriers (i.e. UPS) push for more efficient distribution, the country’s top property developers have chosen to partner with Latch to implement a suite of tools that vastly improve the tenant experience.

Elegantly-designed hardware, enabled by software, and combined with a differentiated go-to-market strategy compelled our initial investment in Peloton years ago. Today, we believe Latch will similarly pioneer a new category of software-driven systems that deliver the convenience, flexibility, and experience an end user desires in an unparalleled way.

For property developers, Latch reduces building expenses — such as annual re-keying costs — and increases property values. For residents, trusted service providers can gain confidential access by smartphone, doorcode, or keycard, for everything from logistics (Latch-UPS) to short-term rentals (Latch-Airbnb Niido). For building managers, Latch offers a suite of software tools that provide guest, package and security capabilities. Lastly, Latch fundamentally restructures the cost model for last mile delivery and services in a way that has the world’s largest package delivery company excited to partner with them.

None of this would have been possible without the humility, foresight and determination of Latch’s founding team who put their heads down for three years to deliver a special product and business to the nation’s leading property developers.

For these reasons and many more, we couldn’t be more excited to partner with Luke, Ali, Thomas, Brian and the entire Latch team in creating a category-defining company.

We’re delighted to welcome Latch and their team to the ‘BAMily’.

P.S. Latch is hiring!

—

DISCLOSURE: Any opinions expressed are solely my own and do not express the views or opinions of my employer. This shall not constitute an offer to buy, sell, or solicit securities. All of the information herein is subject to change without notice. The poster does not represent that the information herein is accurate, true or complete, makes no warranty, express or implied, regarding the information herein and shall not be liable for any losses, damages, costs or expenses related to its adequacy, accuracy, truth, completeness or use. For additional details see: https://lateralthinking.vc/legal/