By Marco DeMeireles and Duncan McGillivary

The gaming industry is undergoing a radical transformation. With over 3 billion players as of 2023, the future of gaming has arrived, and it’s shaping up to be more awe-inspiring and boundary-breaking than ever before.

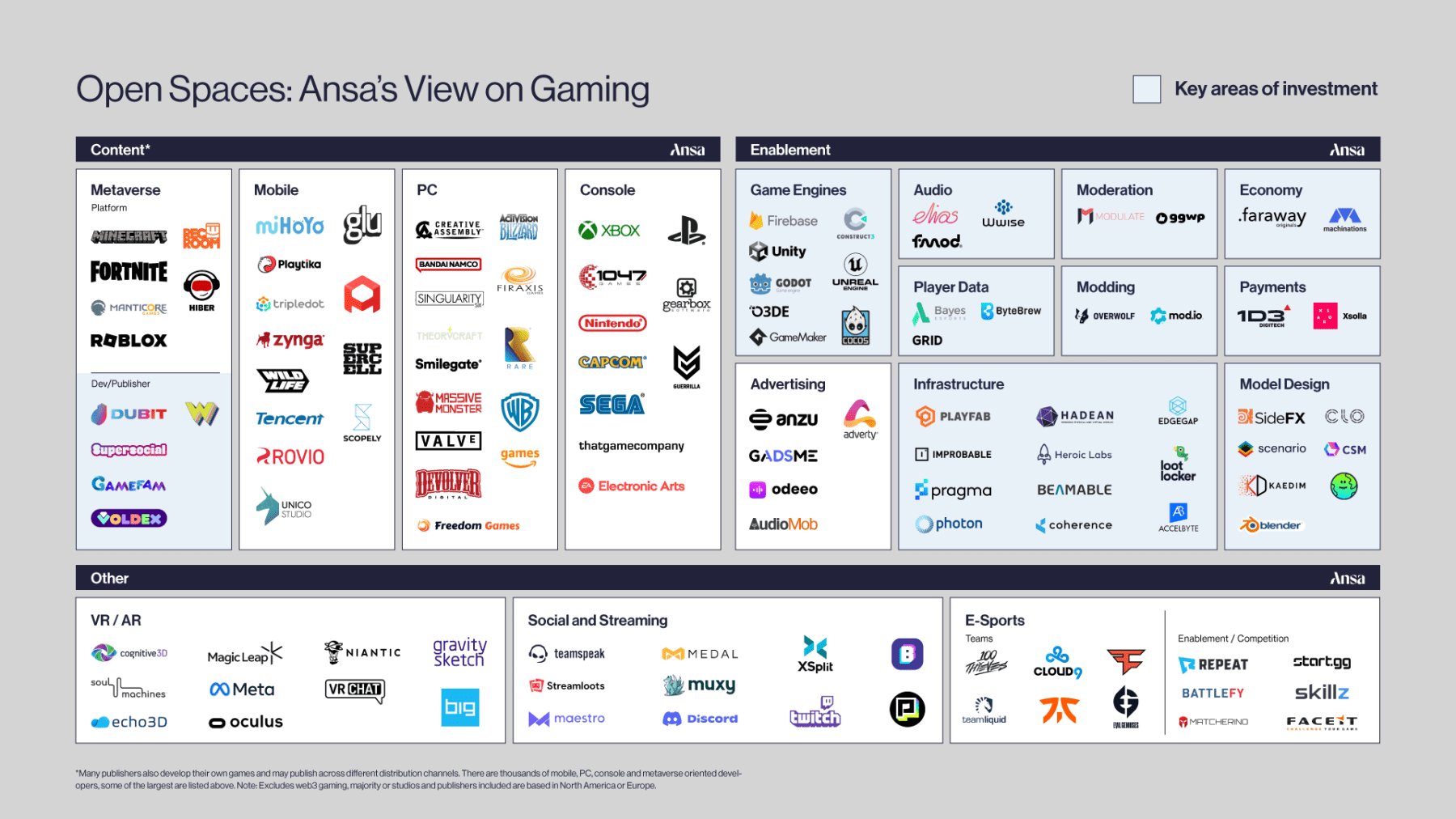

Fueling this rapid growth is the development of new game engines and development tools that make it easier for anyone to create a game, the rise of crowdfunding platforms that allow developers to raise money for their projects, and the growth of digital distribution platforms that amplify game accessibility.

At Ansa, we believe that the companies that evolve from upstarts to household names are the ones that take advantage of “open spaces” — opportunities that emerge as consumer behaviors shift, distribution channels evolve, and markets take shape. The gaming industry is a prime example of this changing landscape and one of the key focus areas for our team.

Below, we’re outlining some trends leading to some of the most exciting — and investable — openings, from demographic shifts to new tech tools.

Everyone is now a Gamer

Within this transformation, a new population of gamers has bloomed. Constituting a formidable 48% of the player base, women have emerged as a potent force within the gaming domain, and the archetypal gamer is also older than you might think. People over 65 devote more time to gaming than those between 35 and 64. This expansion in the player base presents an opportunity, as the landscape is ripe for studios and platforms to reach a broader range of players.

Yet, while the landscape flourishes with diversity, women remain underserved. Despite their significant presence, they are often alienated by the content and marketing of games, which are typically male-oriented. 71% of mothers now play video games, signaling an untapped demand for puzzle-style games, such as the universally adored Candy Crush.

While there have been strides in recent years, with characters like Angrboda from God of War: Ragnarok and Sojourn from Overwatch, too few games feature diverse characters and stories. This lack of inclusion can be alienating for players of color. The future beckons to champions of creative narratives, ready to carve the path toward more comprehensive and inclusive digital realities. Our focus on new markets at Ansa draws us to opportunities that support underserved communities, and we get excited about platforms that can draw in new players.

Farewell to the Traditional Storefront

The traditional channels of distributing games through physical stores and digital marketplaces are quickly becoming outdated as new distribution channels emerge. One of the most promising new distribution channels is games within games. Rather than going directly to Steam or the Microsoft store to find that content, hundreds of millions of players find games they want within the ecosystems where they are already playing. Players can encounter captivating content within the realms they already inhabit. This model can potentially reach a larger audience of players while leveraging IP in a similar way to the early days of mobile.

At Ansa, our ethos is entwined with cultivating pioneering startups within nascent ecosystems. We seek out first movers who can profitably bring high-quality IP and content and rapidly scale using their best practices. We’re also thinking about the future of premium IP. Where will WWE be taken next? How can we bring the world of Harry Potter to life in a new and innovative way? These questions fuel us as we dive into gaming’s tomorrow.

Next-Gen Developer Tools are Here

As games have become more complex, studios have sought solutions to eliminate manual, time-consuming, and expensive game development processes (such as building standalone backends, moderation tools, and economy management platforms). This has led to a broader ecosystem of gaming-oriented development tools, including asset creation and management platforms, back-end management, moderation, and game economy management.

Just as many companies license their game engines today, many studios of tomorrow will choose pre-built solutions for their development stacks. The next generation of tools is still being developed as founders embrace and implement technologies like generative AI to enhance gameplay experiences. The deployment of generative AI and innovative technologies signals a new frontier of seamless gameplay experiences, a terrain we at Ansa invest in ardently.

The Democratization of Game Creation

New technologies allow for a low barrier to entry, as anyone can create and publish games, regardless of their budget or experience. Platforms like Unity and games like Among Us have scaled swiftly despite smaller teams. The viral social deduction game was developed by Innersloth, at the time a team of three, before eventually scaling to hundreds of millions of downloads and over $86M in lifetime revenue by June 2021 (source). GameMaker and Roblox’s native game design tools allow for even more accessible game creation, empowering less technical users.

We expect that game creation will continue to see democratization over time, leading to new gameplay loops, viral games, and ways to play without requiring the capital intensity of large AAA games. We get excited by studios and publishers that can leverage the next generation of these tools, combined with innovative game loops and world-class teams.

Looking Ahead

Spending time with operators and founders in this space has shown us the industry is in flux, with uncharted territories and untapped potential. The themes discussed in this blog post are just a few ways gaming is changing. As the industry continues to grow, innovation and creativity will converge, beckoning pioneers to sculpt the future of gaming.

To the creators and visionaries building the next generation of games and gaming tools, please get in touch. We love having these conversations. Ansa primarily invests $5-30M into post-monetization startups at the forefront of gaming’s bright and promising future. Are you already on the path to constructing this very future? If so, we eagerly encourage you to connect with Marco DeMeireles, marco@ansa.co, and Duncan McGillivary, duncan@ansa.co.